New rules on farmhouse expenses and tax deductibility

We have long enjoyed the simplistic 25% farmhouse expense claim regime for full-time farmers as we thought it was a fair representation of the use of the main farm residence in the farming business. Times are changing however.

The IRD, on one hand, preach simplification of the tax system and reducing compliance costs yet, on the other hand, introduce over-complicated tax law which seeks to address relatively small inequities in the tax system.

If you are a farmer (which includes agricultural and horticultural businesses) and claim costs related to your farmhouse such as electricity, phone, insurance and the like, then this change will affect you and you will need to make changes to your accounting system to bring your claim into line with the new tax law for the 2017/18 year.

For June balance dates, these new rules apply from 1 July 2017. For March balance dates, the new rules applied from 1 April 2017. So for our farmers with a June balance date, you’ll need to make these changes to your accounting system as soon as you’ve coded and filed your June 2017 GST return. For our March balance date farmers, you will need to make the change now (if you haven’t already) and if you need help working out the adjustment to correct what has already been claimed, then we are here to help.

The Nitty Gritty

The IRD have released a 29 page document on the new rules so this short article seeks to inform you in a general sense. We can help apply the rules to your specific situation if required.

The first step is for you to work out whether you are a “Type 1” or “Type 2” Farm.

The distinction is:

Type 1 Farm:

A farming business where the value of the farmhouse (including curtilage and improvements) is 20% or less of the total value of the farm (including improvements attached to the land but excluding crops).

Type 2 Farm:

A farming business where the value of the farmhouse (including curtilage and improvements) is more than 20% of the total value of the farm (including improvements attached to the land but excluding crops).

The tax outcome is generally more favourable for Type 1 Farms. There are various ways to interpret these rules and we can provide more insight if your calculation is bordering on 20%. When calculating values, you can use either cost or a reasonable estimate of market value.

The percentages below are claims for income tax under a partnership, sole trader or other structure which doesn’t involve the payment (or deemed payment) of dwelling rent from the persons residing in the dwelling. For example, many of our clients will have their farm in a trust and will be residing in the dwelling rent free. The farming entity will be incurring the running costs. In these situations the rules below are applicable.

Type 1 Farm rules

- 100% deduction for rates (no change).

- 100% deduction for interest expenses related to the purchase of the farm (no change).

- 50% of telephone rental charges (previously 100%) unless you can substantiate a higher percentage. We can only surmise that the IRD are wanting to see some private allocation for phone rental so claiming 100% of cellphone and home phone will in most cases be indefensible.

- 20% deduction (previously 25%), unless you can substantiate a higher deduction, for all other farmhouse costs such as electricity, house insurance, house R & M etc.

Type 2 Farm rules

- 50% of telephone rental charges (previously 100%) unless you can substantiate a higher percentage. We can only surmise that the IRD are wanting to see some private allocation for phone rental so claiming 100% of cellphone and home phone will in most cases be indefensible.

- Rates, interest expense (related to the purchase of the farm) – apportion based on a fair and reasonable basis. As a suggestion, the value of productive farm land and improvements as a percentage of the total property value would work for rates and interest. On top of this, a further small claim for rates and interest based on a home office claim would be reasonable.

- Other farmhouse costs – apportion based on a fair and reasonable basis. The IRD suggest a “home office” calculation, as applies to other non-farming businesses, would be appropriate for those costs which relate to the farmhouse as a whole and so can not be easily dissected.

The complexity of the rules increase when we consider the appropriate GST claim that is allowed. In the cases where dwelling rent exists, GST doesn’t necessarily follow the income tax treatment. We suggest you contact us for clarity on your situation if you are unsure.

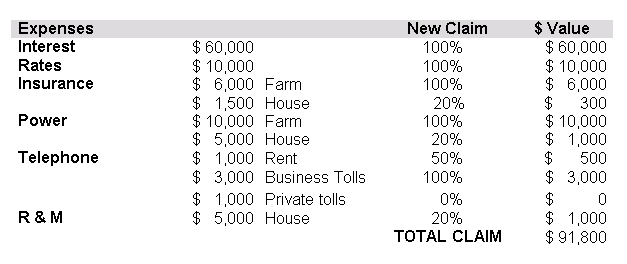

Below is a worked example to get a clearer picture. The expenses are kept the same to highlight the different result between the two types of farms.

Type 1 Farm Example

Frank and Betty have their farm in a Farm Trust. They are beneficiaries of the Trust and it is agreed that they can live rent free as long as they maintain the property and pay the property costs.

Their farming partnership runs the farming operation.

Total Farm Value: $4,000,000

House & Curtilage: $500,000

$500,000/$4,000,000 = 12.5% so less than 20% – qualifies as a Type 1 Farm.

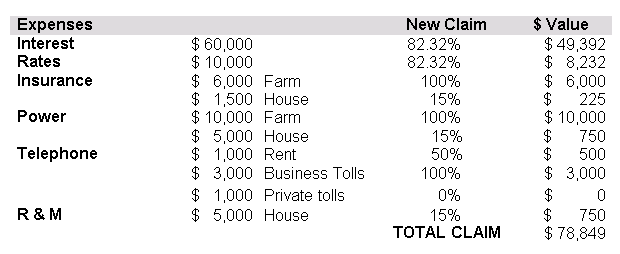

Type 2 Farm Example

George and Mildred own a 20 acre orchard in their own names and run the orchard business through the same partnership. They bought the orchard 5 years ago for $1,500,000. They recently built a new house on the orchard for $400,000. They apportioned off some of the orchard land for the house and gardens and this portion of land was valued independently at $120,000. A valuer has put a value of $2,500,000 on the entire property including trees.

Total Farm Value: $2,500,000

House & Curtilage: $520,000

$520,000/$2,500,000 = 20.8%

Farmhouse value is more than 20% – qualifies as Type 2 Farm.

They calculate their home office area as 10% plus they use the kitchen and facilities for their smoko and store a farm ute and motorbike in the integral garage. They assess an extra 5% is fair. Their “farmhouse” claim adds to 15%. In addition to this, they need to work out an overall business percentage for the interest and rates claim.

Orchard value = $1,980,000 being total property of $2,500,000 less dwelling & curtilage of $520,000.

Home Office = $78,000 being the dwelling & curtilage value of $520,000 multiplied by the 15% home office percentage.

Total business portion equals 82.32% being ($1,980,000 + $78,000) / $2,500,000 (total value of the property).

The difference between the deductible expenses based on the two methods above is nearly $13,000 different – potentially an extra tax cost of over $4,000 for the Type 2 Farm.

Where to from here?

We think these changes will affect every one of our farming or orcharding clients and that there will be no hiding from this law change.

Some farmers in the Type 1 category will choose to wear the reduction from 25% to 20% of allowable deductions because substantiating a higher claim is too hard. For those claiming a higher deduction, record keeping and good supporting documentation will be key.

If we do your GST, we will contact you if we need any clarification, but for Type 1 Farms, we will reduce the claim on farmhouse expenses from 25% to 20% unless you direct us otherwise.

For Type 2 Farms, we will also need to know your office use area and house area and any other parts of the dwelling used for business purposes to calculate the percentage use of the farmhouse.

We anticipate lots of head scratching as people come to grips with these new rules.

It will be important to get this deduction method right for this coming year, otherwise your GST will be incorrect and will need adjusting. If you would like us to help with your calculation and updating your accounting software system, please click here.