Cashmanager Rural – End of financial year checklist

End of financial year checklist

When the new financial year is under way, you should start thinking about getting the financial information for the previous year ready for us to use for preparing your financial returns.

If you haven’t already done so, invite us to log into your Cashmanager RURAL online database.

We can then access reports such as the Accountants Annual and Accountants Livestock Rec and determine what information we need from you.

We will supply you with an end of year questionnaire to complete and some of the questions can be easily answered if the information in your Cashmanager RURAL database is correct.

Things you can check

1. Is your transaction list up to date?

Make sure all transactions have been entered up to the last day of your financial year.

2. Have you reconciled all bank statements relating to the financial year?

Nothing should be left unreconciled except for transactions dated in the new year.

3. Check for unreconciled transactions

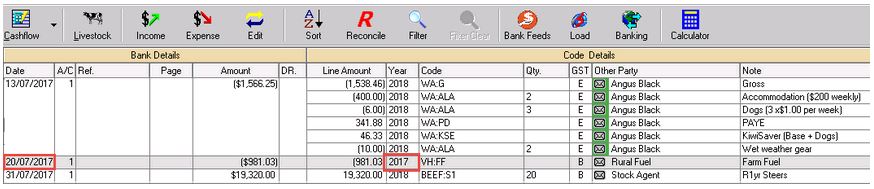

From the Transactions screen, click on the Filter button, tick the Unreconciled box and click OK.

If transactions appear that are dated in the year you are balancing, they may be duplicate or un-presented transactions.

They need to be either deleted or reversed.

To correct any unreconciled transactions from the previous year, have a look at How to correct a duplicate transaction.

4. Have you entered all accounts payable and receivable?

In Cashmanager, these are transactions that are recorded in the first month(s) of the new financial year.

The items have a transaction date that matches the bank and are allocated to the financial year they belong to.

For example, you receive an invoice from your fuel supplier dated in June (2017 year) and you pay it in July (2018 year). You need to show that though the transaction was paid in July, it relates to the 2017 financial year.

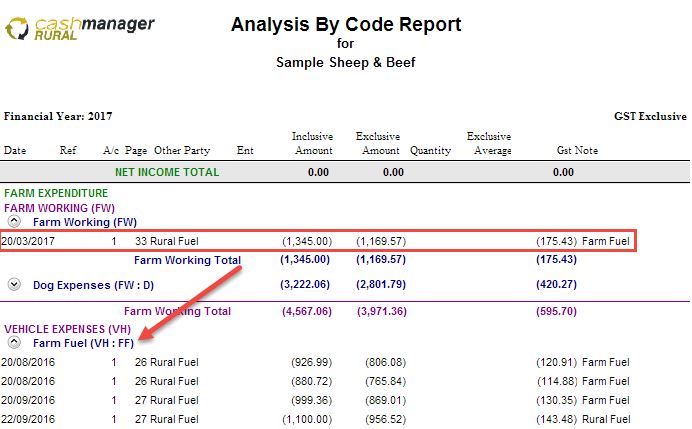

5. Check the consistency of coding

Make sure that you use the same codes for the same types of transactions.

Click on Reports – Analysis by Code. Check that the transactions make sense for the code they are allocated to.

If a transaction needs re-coding make a note of the transaction date, the GST inclusive amount and its code.

Locate the transaction, edit it and change the code.

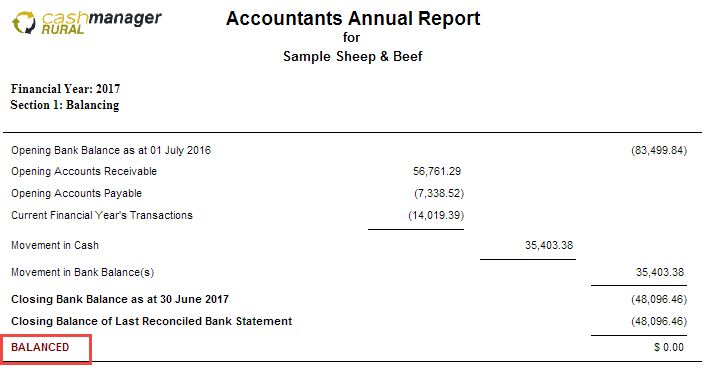

6. View the Accountants Annual Report

Make sure that it is balanced.

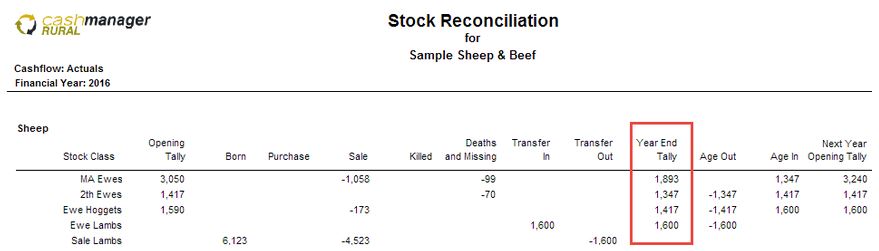

7. Is your Livestock Year End Tally correct?

From the Transaction screen click on Reports – Accountants Livestock Rec.

Livestock tallies do matter so be careful that the stock transactions (sales and purchases) have been coded correctly and that tallies have been recorded.

8. Run a Springclean

From the opening screen, click on Tools – Springclean.

If there are errors, try and fix them.

If you have any queries, please do not hesitate to contact our team.